Debt Collection--Some Tips For Dealing With Old Debt

Many people who have charge-off accounts on their credit simply give up. They mistakenly believe there is nothing else that can be done with the account. That is simply not the case. You still have time to deal with a charge off account before matters get worse.

And who's going to know anyway? Most people who have been subjected to harassing and abusive Debt Collection Software practices won't know their rights anyway. They won't know anything about the FDCPA or about the kinds of rights they have under it. And they won't know that they can sue for violations of the law by debt collectors either. And they won't know anything about the rights they hold under the law or about any kind of enforcement action they might bring to vindicate those rights and recover damages for them. They are simply ignorant about any of this.

Settlement reduces the actual amount of principal debt. A debt negotiator will work with creditors, or more often, Collection Software agencies to reduce the amount of money owed. Once the repayment amount has been agreed to by all parties, the debt negotiator will collect the money from the debtor, hold it in trust, and then pay the debt to the creditor. This option is a good choice for someone who doesn't have the ability to pay the full debt that they owe, but can make some kind of payment. It is a less harmful solution than bankruptcy and a good way to eliminate credit card debt legally.

They cannot threaten you with violence. Remember also, that a debt collector cannot tell someone else that you owe a debt or discuss the details of it. Nor can they leave information about the debt on a 3rd party's answering machine.

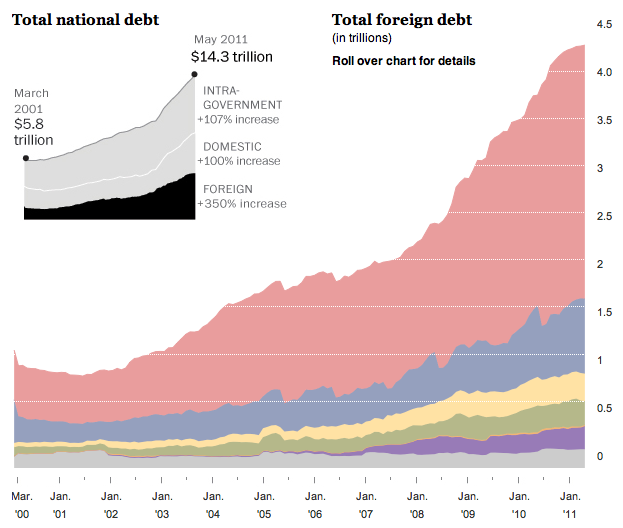

We can consume as much as we want without worrying about acquiring the money to pay for it, because our dollars are accepted everywhere around the world.

Stay committed and active in reducing your debt. Make a budget and stick to it. Slowly but steadily does win the race, and getting out of the debt cycle is a tremendous relief.

No comments:

Post a Comment